How Do I Make a Budget That Works?

Ever made a budget—only to abandon it a few weeks later? Or have you ever arrived at the end of a month only to say, “Where did all my money go?”

For many, budgeting feels like an ideal we know we should follow, but the reality often ends up messy, discouraging, or even forgotten.

Whether you’re earning a stable income or stretching every last bit of your income, the struggle isn’t just about numbers. It’s about aligning your money with your values, goals, and faith.

Here, you’ll find a step-by-step guide to creating a realistic, sustainable, and spiritually grounded budget.

You’ll learn:

- Why most budgets fail and how to fix that

- Biblical principles that offer timeless financial wisdom

- How to set priorities that reflect your faith and life goals

- A simple method to track your income, expenses, and savings

- Tips for staying on track and adjusting when life throws surprises

Now let’s take a look at what practical tools and biblical insights can help you take control of your finances by building a budget that works in real life, honours God, and brings peace of mind.

Why most budgets fail and how to fix that

Many people start a budget plan with good intentions, but it rarely passes the test of reality. This is often due to unrealistic goal-setting, lack of financial literacy, or inconsistent tracking habits. A study exploring personal budgeting challenges found that many individuals struggle to maintain their budgets because they underestimate expenses, they never got a chance to develop long-term planning skills, or they feel overwhelmed by financial discipline demands1. These barriers can lead to frustration and financial setbacks, ultimately discouraging people from sticking with their budgeting efforts.

This is often because the budget they created wasn’t realistic—it didn’t reflect their actual monthly income, fixed expenses, or true spending habits. Instead, it was based on ideal outcomes, not day-to-day realities.

To make a budget that works, begin by being honest.

Write down your estimated monthly income and track your monthly expenses. Include every expense, from rent to snacks. Classify these into categories such as necessities, wants, and savings. The goal is to see where your money goes. From there, you can build a budgeting system that fits your life.

Before diving into the mechanics of budgeting, it’s helpful to understand the deeper wisdom that shapes sound financial practices. That wisdom can be found in Scripture.

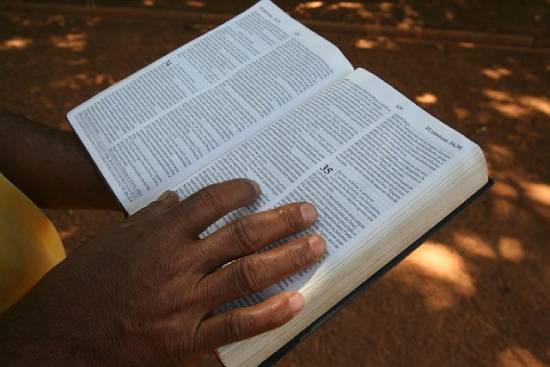

Biblical principles that offer timeless financial wisdom

Image by Célio Silveira from Pixabay

Scripture offers time-tested principles that still apply to budgeting today. The book of Proverbs invites us to plan:

“The plans of the diligent lead surely to plenty, but those of everyone who is hasty, surely to poverty” (Proverbs 21:5, NKJV).

A successful budget plan starts with prayerful planning, self-discipline, and a heart aligned with God’s purpose.

Start by acknowledging that all income comes from God and that we are called to be faithful stewards. This perspective shifts budgeting from a burden to a spiritual act of worship and responsibility. It helps you prioritise all things that involve your finances, from giving to debt management to saving. Applying biblical values to your money management enables you to better resist impulsive decisions while also empowering you to review your habits gracefully and purposefully.

Once your budget is grounded in biblical wisdom, the next step is to clarify your values and long-term direction. Let’s explore how to align your spending with what matters most.

How to set priorities that reflect your faith and life goals

A budget that works reflects your personal values and financial goals. Start by distinguishing needs from wants.

“Needs” include things like housing, food, healthcare, and utilities. “Wants” can be things like dining out, entertainment, impulse buys while traveling, or anything that involves discretionary spending. Categorise every expense accordingly.

The Small Success financial hub recommends the 50/30/202 rule as a working budgeting technique:

- 50% of your monthly income goes to necessities (needs)

- 30% to wants

- 20% to savings and/or debt repayment

Adjust the percentages to fit your season of life. For example, increase the savings and debt category to 30% or more if you have pressing debt.

Make sure your budget supports both short-term needs and long-term financial goals.

Now that you’ve clarified your values and goals, it’s time to consider how to keep your budget practical and transparent. This is where tracking becomes essential.

A simple method to track your income, expenses, and savings

Image by Tima Miroshnichenko

One of the most overlooked steps in budgeting is tracking. Creating a plan is not enough; you must track and compare your spending habits to your budget plan.

Start by using a budget planner or spreadsheet to record:

- Your estimated income for the month

- Your estimated expenses in each category

- Your actual spending

Numerous digital tools and apps are available to help you do this. Some even allow you to connect your bank account and automate the tracking process. This makes it easier to spot patterns, leaks, or overlooked costs that derail your progress.

Once you have a tracking system, the final piece is staying consistent and adaptable. Let’s look at how to keep your budget effective through life’s ups and downs.

Tips for staying on track and adjusting when life changes

Life isn’t static, and neither is your personal budget. You’ll need to review and adjust it regularly.

Look over your budget monthly and ask yourself:

- Did I overspend in any categories?

- Did any new expenses arise?

- Are there spending trends emerging that I couldn’t have predicted that I now need to adapt to?

- Can I automate any payments to simplify my strategy?

Set aside 15 minutes each week to review your progress. Make minor tweaks rather than extensive overhauls. If your income increases or decreases or you eliminate debt, update your budgeting system accordingly.

Also, consider automating your savings and bills to prevent forgetfulness. Creating an automatic system reduces mental load and builds consistency over time. Your goal isn’t perfection—it’s progress.

Your path to a budget that works

Building a personal budget that works is more than crunching numbers. To make it last, it has to also be about creating a life of intention, purpose, and peace. When your budget reflects your values, honours God, and meets your real-life needs, it becomes a tool of empowerment rather than restriction.

It guides you to make wise decisions, stay focused on your goals, and weather financial challenges with confidence.

Start small, be honest with yourself, and don’t be afraid to adapt as your life changes. Over time, the discipline of managing your money with faith and strategy will lead to greater stability, freedom, and fulfilment.

Do you want to learn more tips on finances? The HFA Finance Hub can help.

Start with these helpful and informative articles:

- Phd (c). Romina RADONSHIQI (2016). Science Arena Publications, Specialty Journal of Accounting and Economics. Challenges Of Building A Personal

Budget. https://sciarena.com/storage/models/article/VVl3wxwhcYQO8nIJzrorBhswMxhzrgEPYZYCUqQDnW1epuT3RwH6iiJGPc7v/challenges-of-building-a-personal-budget.pdf [↵] - The Small Success, “The 50/30/20 Budget Rule Explained (And Why It Still Works in 2025)” https://thesmallsuccess.com/50-30-20-budget-rule-explained-why-still-works/ [↵]